What Are The Benefits Of A Makeup Artist

Should I Beginning an LLC for My Makeup Creative person Business?

Some makeup artist businesses will benefit from starting a express liability company (LLC).

Whether or not an LLC is right for this blazon of business depends on whether the business is more of a hobby (and you plan to keep it that fashion) or a true business.

By starting an LLC for your makeup artist business, yous tin protect your personal avails and increase your tax options and credibility.

Our Should I Commencement an LLC for My Makeup Artist Business guide will explain the benefits of an LLC and teach you how to class an LLC.

Recommended: Use ZenBusiness to form an LLC for $39 (plus country fees).

What is an LLC?

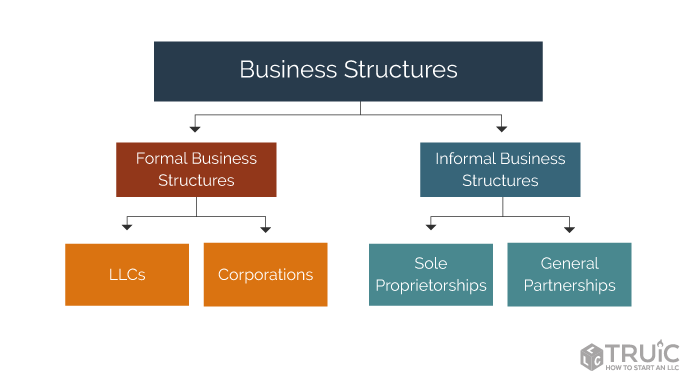

A limited liability company (LLC) is the most popular legal business construction in the US. An LLC offers limited liability protection and taxation options for any size business.

Limited liability legally protects a business owner'due south personal assets in the result that a concern is sued or defaults on a debt.

Virtually small businesses will benefit most from forming an LLC versus other business concern structure types. This is because LLCs are inexpensive, uncomplicated to grade and run, and LLCs tin protect a business possessor's personal assets from lawsuits and creditors.

Some business owners choose to class an LLC themselves, which can exist done by following our step-by-step Class an LLC guides.

Nosotros mostly recommend hiring an LLC germination service so that business owners can focus on generating income and growing their concern.

Recommended: Hire an LLC service for as little as $39. Acquire more than in our Best LLC Services review.

Do I Need an LLC for a Makeup Artist Business?

LLCs are a simple and inexpensive way to protect your personal assets and save money on taxes.

You should class an LLC when there'southward any run a risk involved in your business organization and/or when your business could do good from revenue enhancement options and increased credibility.

LLC Benefits for a Makeup Artist

By starting an LLC for your makeup artist business, you tin can:

- Protect your savings, motorcar, and firm with express liability protection

- Have more revenue enhancement benefits and options

- Increase your business's credibility

Limited Liability Protection

LLCs provide limited liability protection. This ways your personal assets (east.g., motorcar, house, bank account) are protected in the event your business is sued or if it defaults on a debt.

Makeup artists volition benefit from liability protection because of the multifariousness of liability issues related to the physical application of products to clients. In addition to general injuries that may be sustained while the client is inside the confines of your property, sure product allergies nowadays risk.

Example: A client has an allergic reaction to ane of your products. The reaction is severe, and they must spend the night in the hospital.

An LLC volition also protect your personal avails in the event of commercial bankruptcy or loan default.

To maintain your LLC'southward limited liability protection, you must maintain your LLC's corporate veil.

LLC Taxation Benefits and Options for a Makeup Creative person Business

LLCs, by default, are taxed every bit a pass-through entity, just like a sole proprietorship or partnership. This means that the business's cyberspace income passes through to the owner's individual tax return.

The business's net income is and so field of study to income taxes (based on the owner's taxation bracket) and self-employment taxes.

Sole proprietorships and partnerships are taxed in a similar style to LLCs, only they practise not offering limited liability protection or other revenue enhancement options.

South Corp Pick for LLCs

An S corporation (Due south corp) is an IRS taxation status that an LLC can elect. Southward corp status allows business concern owners to be treated as employees of the business (for taxation purposes).

South corp tax condition tin reduce self-employment taxes and will allow business owners to contribute pre-revenue enhancement dollars to 401k or health insurance premiums.

The S corp status requires that the business pay the employee-possessor(due south) a reasonable salary for the work they perform.

In improver, the business organisation might need to spend more on bookkeeping, bookkeeping, and payroll services. To offset these costs, you'd need to be saving about $ii,000 a twelvemonth on taxes.

We guess that if a makeup artist concern owner can pay themselves a reasonable salary and at least $10,000 in distributions each year, they could benefit from Southward corp status.

You tin can beginning an S corp when you course your LLC. Our How to Start an S Corp guide will lead you through the process.

For questions almost revenue enhancement solutions for your makeup creative person business organization, nosotros recommend scheduling a free revenue enhancement consultation.

Credibility and Consumer Trust

Makeup artists rely on consumer trust. Credibility plays a cardinal role in creating and maintaining any business organization.

Businesses gain consumer trust only past forming an LLC.

A growing business can also benefit from the brownie of an LLC when applying for small business loans, grants, and credit.

ZenBusiness will get-go an LLC for yous for but $39 (plus land fees).

Get Started

How to Form an LLC

Forming an LLC is easy.There are 2 options for forming your LLC:

- You tinhire a professionalLLC germination service to fix upward your LLC for a small fee

- Or, yous can choose your state from the list below to beginning an LLC yourself

Step ane: Select Your Country

- Alabama LLC

- Alaska LLC

- Arizona LLC

- Arkansas LLC

- California LLC

- Colorado LLC

- Connecticut LLC

- Delaware LLC

- Florida LLC

- Georgia LLC

- Hawaii LLC

- Idaho LLC

- Illinois LLC

- Indiana LLC

- Iowa LLC

- Kansas LLC

- Kentucky LLC

- Louisiana LLC

- Maine LLC

- Maryland LLC

- Massachusetts LLC

- Michigan LLC

- Minnesota LLC

- Mississippi LLC

- Missouri LLC

- Montana LLC

- Nebraska LLC

- Nevada LLC

- New Hampshire LLC

- New Jersey LLC

- New Mexico LLC

- New York LLC

- Due north Carolina LLC

- North Dakota LLC

- Ohio LLC

- Oklahoma LLC

- Oregon LLC

- Pennsylvania LLC

- Rhode Isle LLC

- S Carolina LLC

- South Dakota LLC

- Tennessee LLC

- Texas LLC

- Utah LLC

- Vermont LLC

- Virginia LLC

- Washington LLC

- Washington D.C. LLC

- West Virginia LLC

- Wisconsin LLC

- Wyoming LLC

For virtually new business concern owners, the best state to form an LLC in is the state where yous live and where y'all plan to conduct your business organization.

Footstep 2: Proper name Your LLC

When you file your LLC'due south formation documents, you lot'll need to give your makeup creative person business a unique proper name.

Need help naming your business organization? Use our free Business organisation Name Generator and our How to Name a Business guide to get started.

Once you discover a business organization name, bank check if your name is available every bit a spider web domain with GoDaddy.

Notice a Domain Now

Once yous've secured your domain proper name, have the next steps. Learn how to create a website and so create a logo using our free logo maker.

Pace 3: Choose an LLC Registered Agent

Your LLC registered agent will have legal documents and taxation notices on your LLC'southward behalf. You lot will list your registered agent when you file your LLC's Manufactures of Organisation.

Hiring a registered agent service offers a number of benefits, including privacy and peace of mind.

Many of these Best LLC Services offer a free year of registered agent service when yous hire them to form an LLC.

Pace four: File Your LLC'southward Articles of Organization

The Articles of Organization, besides known as a Certificate of Formation or a Certificate of Organisation in some states, is the document y'all volition file to officially register your LLC with the state.

Pace 6: Go an EIN

An Employer Identification Number (EIN) is a number that is used past the The states Internal Revenue Service (IRS) to place and tax businesses. It is essentially a Social Security number for a business concern.

EINs are free when you lot utilise straight with the IRS. Visit our What Is an EIN guide for instructions for getting your costless EIN.

Should I Start an LLC FAQ

Which is better for my makeup artist business — an LLC or sole proprietorship?

Choosing the right business structure depends on your business'southward unique circumstances and needs. However, unless your business is very low adventure (like a hobby), an LLC is likely the ameliorate option.

Visit our LLC vs. Sole Proprietorship guide to acquire more.

How much does an LLC toll for a makeup artist business concern?

The cost of an LLC depends on which state you form your LLC in. The primary toll of forming an LLC for your makeup creative person business organisation is the state filing fee. This fee ranges from $40 to $500 depending on your state.

You can read more details in our How Much Does It Cost to Kickoff an LLC guide.

How exercise I pay myself from my makeup artist LLC?

How LLC owners pay themselves depends on how the LLC is taxed, the number of members, and any agreements regarding turn a profit sharing and sweat equity.

Visit our How Do I Pay Myself From My LLC to learn more.

What is limited liability protection?

Limited liability protection is 1 of the benefits of an LLC. Information technology means that the owner's personal assets are protected if the company is sued or goes into debt.

Visit our corporate veil guide to larn more about maintaining your LLC's limited liability protection.

Is an LLC adept for a makeup creative person concern?

Yep. An LLC will requite y'all personal liability protection against potential business organisation risks also as requite your makeup artist business more taxation options and brownie. Information technology is relatively inexpensive and simple to class and maintain an LLC.

Learn more than virtually makeup creative person LLC benefits.

When would I beginning a corporation vs. LLC for my makeup artist business?

Corporations are complex to manage and they are subject field to double taxation. For this reason, most small-scale businesses won't benefit from starting a corporation.

When you know your makeup artist business organisation will need to rely on outside investors, then a corporation might be the right pick.

Acquire more in our LLC vs. Corporation guide.

What is a corporate veil?

The corporate veil describes the limited liability protection (sometimes referred to equally personal nugget protection) provided by corporations and LLCs. If the corporate veil isn't properly maintained, the corporation or LLC might lose its limited liability protection.

What are the benefits of starting an LLC for my makeup artist concern?

Some advantages of an LLC include personal asset protection, reduced paperwork when compared to corporations, taxation flexibility, and increased credibility with customers and creditors.

Is a single-member LLC the same equally a sole proprietorship?

No. A single-fellow member LLC is a blazon of limited liability company, which is unlike from a sole proprietorship. Unlike sole proprietorships, a single-member LLC is formed past filing organisation documents with your state government office.

Single-fellow member LLCs are legal business structures that offering liability protection, branding, credibility, and privacy that a sole proprietorship doesn't.

Do I need to open a business depository financial institution business relationship for my LLC?

Using a dedicated business banking account for your makeup artist concern is essential for personal nugget protection.

When you lot mix your personal and business accounts, your personal assets (e.g., your home, car, and other valuables) are at chance in the result your LLC is sued. In business law, this is referred to as piercing your corporate veil.

Can I transfer my makeup artist business'southward DBA name to my LLC?

The rules regarding DBAs can vary from state to state. Read our How to File a DBA guide for more information.

What are the costs to start and maintain a makeup artist business?

Visit our How to Start a Makeup Creative person Business guide to acquire more than about the costs of starting and maintaining this concern.

What are the ongoing expenses of running a makeup artist concern?

Ongoing expenses to consider volition be the cost of advertising, the cost of additional supplies as y'all proceed, and the toll of gas associated with your travels.

Learn more about running a makeup artist business.

How do makeup artist businesses make coin?

Primarily, makeup artists make money by charging fixed prices for a diverseness of different makeup services that they provide.

Learn more than about starting a makeup creative person business.

What is a makeup creative person business and is it lucrative?

Whether selling makeup services or bodily products to clients, makeup artists are important for special occasions. While the primary audition of makeup artists is young to middle-anile women, trends in professional and personal photoshoots accept ultimately opened up the opportunity to a whole new population.

Every bit a high contiguous contact service, makeup artist businesses stand to proceeds from new client opportunities by give-and-take of mouth and social media advertising. The average profit margin for a makeup artist business needs to be at least 40% to exist sustainable.

Learn more than virtually starting a makeup artist business.

Related Articles

Commodity Sources

Take a Question? Leave a Annotate!

What Are The Benefits Of A Makeup Artist,

Source: https://howtostartanllc.com/should-i-start-an-llc/makeup-artist-business

Posted by: lesherporwhou.blogspot.com

0 Response to "What Are The Benefits Of A Makeup Artist"

Post a Comment